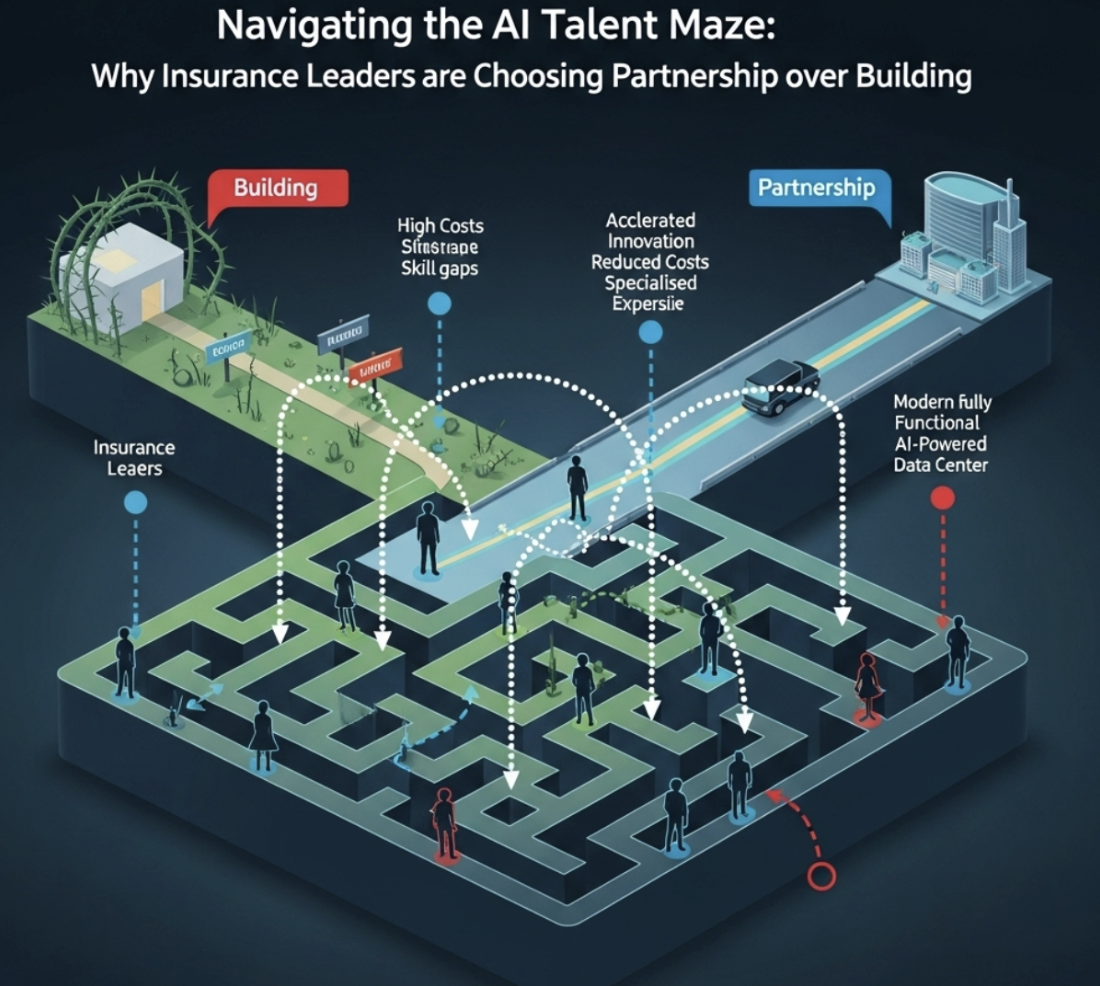

For CIOs, CTOs, and VPs of Engineering in the insurance sector, the imperative to leverage Artificial Intelligence is no longer a question of 'if,' but 'how' and 'how fast.' The competitive landscape is rapidly evolving, driven by agile InsurTech companies that are rewriting the rules of engagement with AI-powered efficiency and intelligence. However, for small and mid-tier insurance carriers, the path to building a world-class in-house AI capability is fraught with significant challenges:

The Scarcity and Cost of Top-Tier AI Talent:

The demand for skilled AI engineers, data scientists, and machine learning experts far outstrips the supply. This intense competition drives up salaries to levels that can be prohibitive, especially for companies with tighter budgets. Recruiting individuals with the specific expertise required for cutting-edge areas like Generative AI and Agentic Frameworks is an even steeper climb. Beyond the initial hire, retaining this talent in a dynamic and often more appealing startup environment presents an ongoing hurdle.

The Complexity of Skillsets and Development:

Building sophisticated AI systems for insurance requires a unique blend of expertise:

- Deep AI/ML Knowledge: Proficiency in areas like natural language processing (NLP), computer vision (if applicable), predictive modeling, and, crucially, the nuances of Generative AI and Agentic architectures.

- nsurance Domain Acumen: A fundamental understanding of insurance processes, underwriting principles, regulatory requirements, and the specific challenges within the industry.

- Cloud Engineering Proficiency: Expertise in cloud platforms (AWS, Azure, GCP), data engineering pipelines, and scalable infrastructure to support AI workloads.

- Software Development Best Practices: The ability to translate research into robust, production-ready applications with a focus on scalability, security, and maintainability.

Finding individuals who possess this multi-faceted skillset is exceptionally rare. Building a team with all the necessary components takes considerable time and resources. Furthermore, the rapid pace of innovation in AI necessitates continuous learning and upskilling, adding another layer of complexity to in-house development.

The Protracted Timelines of In-House Development:

Developing AI-powered solutions from the ground up is a time-intensive process. It involves:

- Talent Acquisition and Team Building: Months can be spent identifying, recruiting, and onboarding the right individuals.

- Infrastructure Setup and Data Integration: Building the necessary cloud infrastructure and integrating disparate data sources is a significant undertaking.

- Research and Development: Experimenting with different AI models, fine-tuning algorithms, and developing custom Agentic Frameworks requires iterative testing and refinement.

- Deployment and Scaling: Transitioning AI models from research to production and ensuring they can handle real-world workloads demands robust engineering capabilities.

In a rapidly evolving market, these extended development timelines can mean falling behind the competition, missing critical market windows, and ultimately losing market share.

The Inherent Challenges of Building Novel AI Systems:

Venturing into the realm of Generative AI and Agentic applications is cutting-edge work. In-house teams, especially those new to these technologies, will inevitably encounter unforeseen technical challenges, requiring significant research, experimentation, and potential pivots. This learning curve can further extend development timelines and increase costs.

The Strategic Advantage of Partnering with Nativeorange:

For insurance carriers aiming to not just keep pace but lead in this new era, partnering with a specialized InsurTech like Nativeorange offers a compelling and strategic alternative to the arduous journey of building everything in-house.

Nativeorange brings to the table:

- Deep Insurance Domain Expertise: Our team comprises professionals with decades of combined experience within the insurance industry. We understand your business, your challenges, and your opportunities intimately.

- Proven Cloud Proficiency: We are experts in architecting and deploying scalable and secure solutions on leading cloud platforms, ensuring your AI initiatives have a robust foundation.

- Established Generative AI and Agentic Application Experience: With over three years dedicated to building and deploying Generative AI and Agentic Frameworks specifically for the insurance sector, we have a wealth of practical knowledge and a portfolio of ready-to-deploy solutions. We have navigated the complexities of these technologies and can provide a fast track to value realization.

- Accelerated Time-to-Market: By leveraging our existing expertise and pre-built components, you can bypass the lengthy recruitment, infrastructure setup, and initial R&D phases, deploying advanced AI capabilities in a fraction of the time it would take to build them internally.

- Cost-Effective Innovation: Partnering allows you to access top-tier AI talent and cutting-edge technology without the ongoing overhead and long-term commitments of building a large in-house team. Our solutions are designed to deliver a high return on investment quickly.

- Focus on Your Core Business: By entrusting your AI innovation to Nativeorange, your internal technology teams can focus on maintaining and enhancing your core systems, ensuring business continuity and operational stability.

- Mitigation of Development Risks: Our proven track record in building and deploying these advanced AI applications significantly reduces the risks and uncertainties associated with in-house development.

In conclusion, the race to leverage Agentic AI in the insurance industry is on. For CIOs, CTOs, and VPs of Engineering at small and mid-tier carriers, the strategic choice is clear. By partnering with Nativeorange, you gain immediate access to the specialized talent, proven methodologies, and cutting-edge technology needed to not just compete, but to lead the industry into the future. Let us help you transform the InsurTech challenge into your greatest competitive advantage.