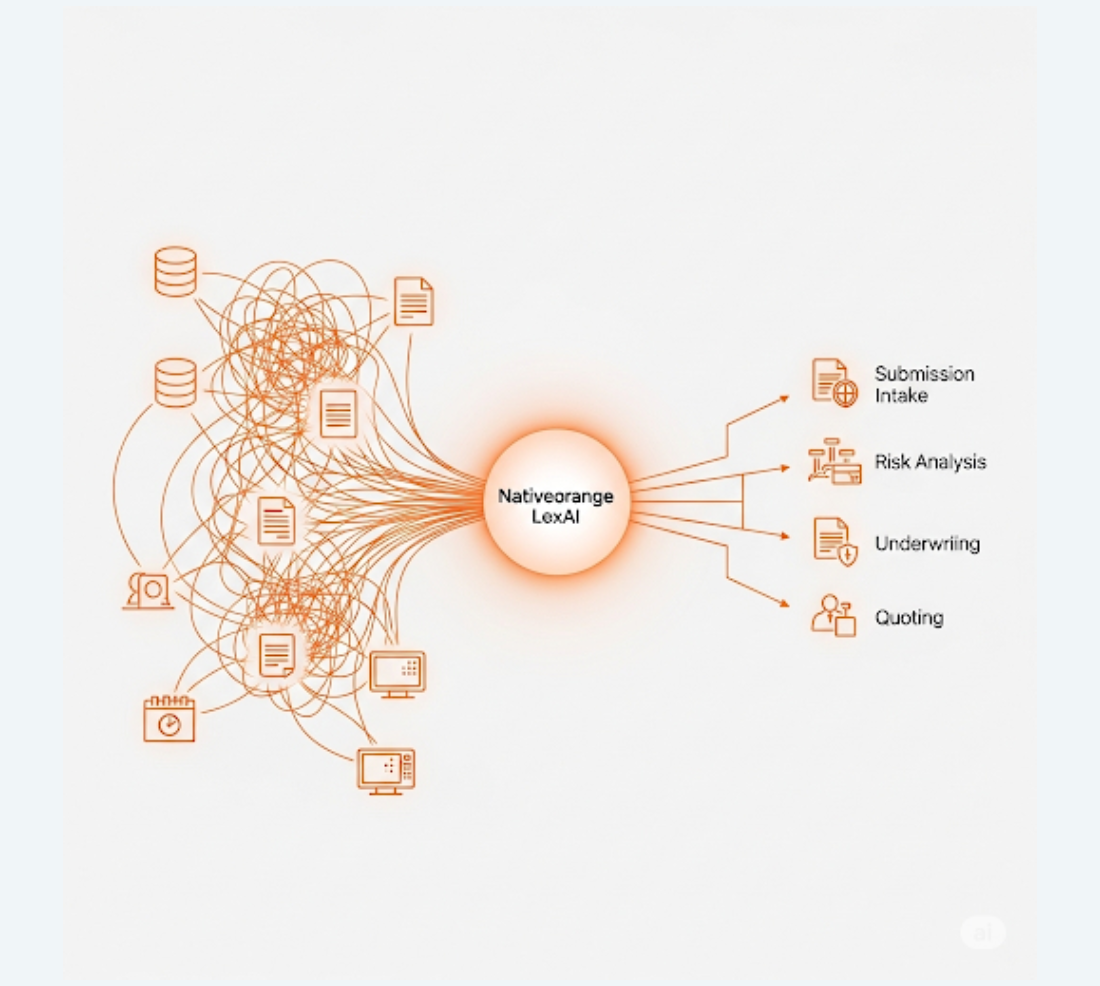

The promise of Artificial Intelligence to revolutionize insurance operations – from faster submission intake to more precise risk analysis and dynamic quoting – is undeniable. However, for most established insurance carriers, the path to realizing this potential is riddled with a significant hurdle: system integration.

The reality for many Insurance Leaders and Executives is a complex web of disparate systems accumulated over decades. Submission intake often involves manual data entry from various document formats. Risk analysis relies on pulling data from aging databases and actuarial platforms. Underwriting workflows are embedded within legacy insurance software. Quoting engines may operate independently, and policy management systems often lack seamless connectivity with newer technologies.

Integrating AI solutions into this intricate environment presents a multitude of challenges:

The Tower of Babel: Diverse Systems and Data Formats:

Carriers grapple with a heterogeneous landscape of applications built on different technologies, using proprietary data formats, and lacking standardized communication protocols. Integrating AI models that require consistent and clean data across these silos becomes a monumental task.

The Legacy Drag: Interfacing with Core Insurance Platforms:

Modern AI systems need to interact seamlessly with core insurance platforms, which often have complex APIs or limited integration capabilities. Extracting relevant data and pushing AI-driven insights back into these systems requires specialized knowledge and can be time-consuming and costly.

The OCR and Document Processing Bottleneck:

AI-powered submission intake relies heavily on accurate Optical Character Recognition (OCR) and intelligent document processing. Integrating these tools with existing document management systems and ensuring data fidelity across various document types (applications, loss runs, etc.) is a complex engineering challenge.

The Data Silo Problem: Unlocking Value from Legacy Databases:

Vast amounts of valuable historical data reside in legacy databases, often in formats that are not easily accessible or compatible with modern AI analytics tools. Building robust data pipelines to extract, transform, and load this data into AI-ready formats is a critical but challenging undertaking.

API Availability and Compatibility Issues:

While APIs are the cornerstone of modern integration, not all legacy systems have well-documented or readily available APIs. Even when APIs exist, ensuring compatibility and seamless data exchange between different systems and AI models can be technically demanding.Further, technologies like Model Context Protocol obviate the need for APIs and offer a modern way for Agentic Applications to interact with tools

Security and Compliance Concerns:

Integrating new AI systems with sensitive insurance data necessitates robust security measures and adherence to stringent regulatory compliance standards. Ensuring data privacy and security across interconnected systems is a paramount concern and adds another layer of complexity to the integration process.

How Nativeorange LexAI Simplifies Integration Through Dynamic Connectivity:

Nativeorange LexAI is specifically designed to address these intricate integration challenges, enabling carriers to seamlessly weave AI capabilities into their existing technology ecosystem. Our approach leverages a suite of dynamic connectors and intelligent tools:

- API-MCP Architecture: LexAI is built with a strong API-MCP Architecture, making it inherently designed for integration. Our platform offers well-defined APIs that facilitate secure and efficient communication with a wide range of internal and external systems. For Modern platforms offering MCP tools we natively communicate with them via our MCP Clients.

- Intelligent Agentic Connectors: Beyond traditional API integrations, LexAI utilizes intelligent agents that can understand and interact with systems even when direct APIs are limited. These agents can automate data extraction, transformation, and workflow orchestration across different platforms, mimicking human interaction where necessary.

- Leveraging Standard Protocols like A2A (Agent-to-Agent): We embrace and implement open protocols like Agent-to-Agent communication frameworks. This allows LexAI to interact and exchange information seamlessly with other intelligent systems and components within the carrier's environment, fostering a more interconnected and efficient ecosystem.

- Integration with MCP-like Orchestration Frameworks: LexAI is designed to integrate with open standards like Model Context Protocol (MCP) and similar frameworks. This allows for seamless access to tools and data sources.

- Dynamic Data Mapping and Transformation: LexAI incorporates intelligent tools that can dynamically map and transform data between different formats and systems. This reduces the need for extensive custom coding and simplifies the process of preparing data for AI processing including our Accelerators for direct imports from legacy systems.

- Pre-built Connectors for Insurance Systems: Nativeorange is continuously building and refining pre-built connectors for popular insurance software, significantly accelerating the integration timeline.

- Secure and Compliant Integration: Security is paramount. LexAI's integration methodologies prioritize data encryption, secure authentication, and adherence to industry compliance standards, ensuring the integrity and privacy of your sensitive information.

Fast-Tracking Your AI Journey:

By partnering with Nativeorange and leveraging LexAI's dynamic connectivity capabilities, insurance carriers can significantly fast-track their AI adoption journey. Instead of being bogged down by complex and time-consuming integration projects, your IT and engineering teams can focus on leveraging the insights and efficiencies that AI provides.

Our decades of combined experience in the insurance domain, coupled with our deep expertise in cloud and AI technologies, including over three years of dedicated experience building Generative AI and Agentic applications, uniquely positions Nativeorange to understand and solve your integration challenges.

Let us help you break down the integration barriers and unlock the transformative power of Agentic AI across your insurance value chain. Contact Nativeorange today to learn how LexAI can connect your systems and propel you to the forefront of the industry.